I use the average of four valuation techniques. Two are forward looking, two are based on historical facts. I'll run through the calculation with XOM since it was one of my latest purchases.

Dividend Discount Model:

You can use google to learn about the theory if you want, I'm not going to get into that. However, it will tell me what the expected future dividend payouts are worth in today's dollars. Quite useful to an income investor such as myself. This is forward looking.

|

| Current Dividend. I used yahoo.com |

|

| 5 Year Dividend Growth. I used fidelity.com |

|

| Input the first two values. I use a 10% discount rate with the exception of utilities and telecoms. This is a spreadsheet setup by JC at http://www.passive-income-pursuit.com/ |

Discounted Cash Flow Model:

This valuation technique is also forward looking and can be used for all types of c-corps, not just dividend stocks. If a stock has EPS of X that is expected to grow Y% per year, what is it worth in today's dollars? DCF has an answer to that question. If you want more information about DCF, please google it. This post is going to be long enough as it is.

|

| EPS taken from yahoo.com |

|

| This number is derived from analysts expectations and taken from fidelity.com |

|

| Again I use a 10% discount rate. I used a free online calculator at the following website: http://moneychimp.com/articles/valuation/dcf.htm |

XOM did great with the DCF calculation. Again this is only one calculation. Let's not get too excited yet. $125.33

Average P/E:

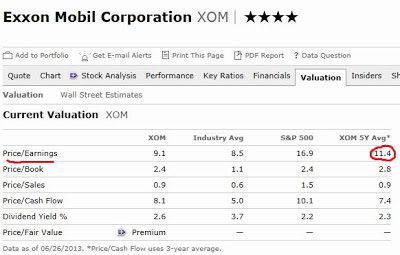

Most if not all value investors place at least some faith in the P/E ratio. It's a quick way to gauge a company's valuation. That's great and all, but just knowing the P/E ratio won't tell me much. Is a 15 p/e good for XOM? What about a 10 p/e? Well one way of answering that question is to see what the historical p/e for XOM typically is. If XOM has a historical p/e of 10, I would argue that when the current p/e is 10 it is fairly valued. Anything less than 10 is attractive, while anything over 10 could be considered be over valued.

The goal here is figure out an actual dollar amount. Saying "over valued" or "under valued" isn't good enough. I want to break it all down into one number.

|

| XOM has a current EPS of 9.83 Taken from yahoo.com |

So if XOM had a P/E of 11.4 (historical average) I would consider it fairly valued. If it had a 11.4 P/E right now (based on the current EPS) it would be a $112.06 stock. Indeed XOM does look undervalued here. Now I have a number!

Average Yield:

This method is very similar to the average p/e. Dividend stocks are often bought because they provide income! If the current yield is high, investors will snatch up shares. If XOM yielded 5% right now, everyone and their brother would be buying as much as they could. I know I would. XOM wouldn't stay at a 5% yield for very long. Think about that. It's a key driver, along with EPS and dividend growth, of why income stocks tend to appreciate in value over time. When a stock has a high yield it is worth more to an income investor.

So how do we know what a decent yield for XOM is? Average yield. I consider the average yield to be another indication of fair value, just like average p/e. If you can get in at the historical yield you are not over paying because XOM is an income instrument. Now we have to put it into a number.

|

| It is quite obvious that XOM normally offers a lower yield than it does today. An indication that it is under valued. This picture was taken from Morningstar.com |

|

| Current Dividend. I used yahoo.com |

Calculated FV for XOM Stock:

Take the average of the four calculations and you'll get $102.46. The last time I performed the calculation is was closer to 103. I bet the low current p/e dragged down the historical average a little, while the high current yield increase the historical yield a tiny bit since the last time I crunched the numbers. I only do them once per quarter, it is quite tedious.

These are the four methods I find most useful. The ones that fit my strategy as a hybrid income & value investor. I don't want to dwell on the past, yet I cannot predict the future. I find great comfort in the history of fantastic, proven companies. Can the streak continue? How accurate are analysts? I try to take all that into account.

This is not an exact science, and should be considered an estimate! Be aware that p/e's expand and compress over time. Be aware that interest rates might affect dividend stocks because they are income instruments. If I could get a 6-7% yield on bonds backed by the full faith of the US government, I'd have to think long and hard about buying an equity with a 2.8% yield. At 10%, bonds are a no-brainer. I like to use a 5 year period because it encompasses the great recession. Using a 10 year period might be a better historical comparison. Then again a business can change drastically over 10 years. There are other useful techniques. Some people use the graham number. I don't. It's up to you!

Thanks for the link. I thought that looked familiar.

ReplyDeleteIs the M* sources free or does that come with the premium membership? I'm with you on XOM being undervalued here as I started and doubled my position in XOM this month. Too bad there wasn't the capital to go from 100-200 shares.

I like learning some other's blogger's valuation techniques. I always pick up something from their posts.

All the data I used from Morningstar is free, if you look at my screen shots you'll see exactly where I went. I don't pay for any subscription, except FAST GRAPHS once per quarter. I still need to work out a method for valuing MLPs and REITs. Until I figure out how I want to do it, I'll go with FAST GRAPS or maybe even the Morningstar FV estimate. That's free too.

DeleteThank you for stopping by PIP! I love your blog and your dedication to achieving your goals! Not many people are as dedicated as you are. You, Dividend Mantra, and the ERE crowd have no equal in that regard. You guys are way ahead of me, I think that is because I am putting in 20 years for a guaranteed pension.

That 20 year for a lifetime pension is great. My uncle is retiring from the air force at the end of the year, although I think he put in a bit more than 20 years. Thanks for your service and glad to have you back stateside. How much longer do you have til the 20 year mark?

DeleteThanks for the kind words. The focus was really kind of forced upon me due to my layoff. I enjoyed my time off much more than I probably should have but it instilled a sense in me to get back to having all of my time. You've got to find a system that works for you. Considering you're saving and investing while working towards those 20 years you're going to do just fine. And I know you're much further ahead than most military personnel. If you think about it the 20 years you put in are still right around what most people striving for FI will hit. It might be plus or minus a few years, but it's still much earlier than retiring at 65, or worse still working when you're 80.

I'm going to have to go play around with M* more to see what kind of goodies I can find.

CI,

ReplyDeleteGreat post! I essentially go through the same process myself. I like to use a DDM (I don't use DCF as much as I should) and then compare P/E and yield to historical norms. Then I'll look at the Fair Value that analysts give and try and average this all together. Also, by following the market for over three years now I get a pretty good "gut" feeling for the valuations certain companies tend to command. In the end it's more art than science, and always best to get as much of a margin of safety below whatever you think intrinsic value appears to be. I try to aim for at least 10% and go from there unless the company is super high quality.

Best wishes!

Yeah I use my gut feeling sometimes. We've been following the same companies for many years. Without doing calculations I usually know if something is priced right. The thing is, when I look back at the track record of stock valuing, it has been pretty accurate. If all four calculations are close to each other I am extremely confident the fair value estimate is right. Actually Morningstar is pretty darn good too!

DeleteI would like to see someone post their methods for valuing REITs and MLPs.

Great read and always something valuable to learn. Thank you. I am in my late 20s and started investing since last year. I am always delighted to find a new post on your blog. I had meant to ask you why doesn't AAPL fit in your list of dividend paying stocks?

ReplyDeleteAwesome Robbie! I started getting serious about investing my late 20's also.

DeleteAAPL does pay a dividend and it seems like the company is willing to raise it. The reason why I don't own or follow it closely is two fold. First of all, I want to own businesses for extended periods of time. When I buy part of a business I want to be a part owner for 10, 20, maybe even 50 years. With Apple I just don't know where the company will be that far down the road. They must continually come up with products that are the latest and greatest. If they don't look out! It just seems like too many unknowns. It is true they have been setting the world on fire the past few years, but can it continue? Also the competition is catching up which can negatively affect volume and margins and hence profits. I own an Android phone (bought while I was in Korea, it displays both English and Korean haha). It does everything I need and then some. While Apple iphones are amazing products, I don't need one. I have tremendous respect for Steve Jobs as a visionary. Lots of love for him! I worry now that he's gone though.

Second of all, I do not like tech stocks in general. I already own enough for my liking. The tech landscape changes too fast, again too many unknowns. I'm not trying to get rich quick. I don't need to own the hot stocks such as AAPL, GOOG, or NFLX to achieve my goals. In fact I prefer boring companies that sell razors, toilet paper, electricity, petroleum products and the like. The type of products we will always need. Even if I lost my job, I'd still need to wipe my behind or see in the dark. Companies that sell those types of products tend to the ones I trust because they are reliable and predictable.

I own INTC from the tech sector because I feel the need for microprocessors will not go away as computers and mobile devices evolve. It's almost like a raw material. Some of my other holdings are not in the tech sector, but are similar. EMR and RTN are engineering companies innovating new products and technologies even though they are considered industrial stocks. AT&T is pretty tech heavy even though it's a telecom.

AAPL doesn't have a rich or storied history as a dividend paying company. I don't think dividends are ingrained in the culture just yet. If it can continue designing the best products on earth, it would be great holding however. It has done a great job branding itself, we know what to expect from an Apple product. There seems to be room for quite a bit of dividend growth too. It's a shame Steve Jobs is no longer with us... what a talent!

Cheers!

Hi CI,

ReplyDeleteI find your post very useful and the information is well layed out; clear, concise and very easy to understand. It's great that you showed where to get the numbers. I have often heard of the Dividend Discount Model and the Discounted Cash Flow Model but never looked it up. Keep up the good work.

Thanks buddy!

DeleteA great thanks to you for sharing these great facts over how can we earn profits by investing our money in dividend stocks. This is really a concise write-up over investing in stock market. For gaining high in stock market, it is recommended to hire professionals who may let you available the most sort after stocks which allow you earn big or you can say a steady cash flow every month. I am sharing a website which really are professionals in this industry and ensure to provide you the excellent stocks with great return over investment. Here is the website :https://www.doubledividendstocks.com/

ReplyDeleteit's a key driver, along with EPS and dividend growth, of why income stocks tend to appreciate in value over time.

ReplyDeleteStock Market

Bitcoin Finance - Deposit $1000 Return $20000 in 24 hours

ReplyDeleteWe offer you a fixed rate and high income with most convenient plan terms for you. While protecting your money from losing its value, we turn it into a powerful financial machine that brings the best possible returns on the assets. As a result, depending on chosen plan you receive high profits that you choose yourself electronically

Deposit Page

http://www.citrusfinance.net

Guaranteed Paid

http://www.payinghyiponline.com/Citrusfinance.html